Holidays

Choosing a tax professional: what you need to know

The hubster and I have been going to H&R Block since the first year that we had to file taxes. Back then, both he and I were in college and really needed help figuring things out – like what we could deduct, what we had to declare, etcetera. Most importantly, we wanted to know how to get the biggest refund. We started going to H&R Block simply because they seemed reputable and they were really convenient (because really, they’re everywhere). It didn’t even dawn on us that there were special things that we had to keep an eye out when it came to choosing a tax professional. We lucked out when we got ours.

Fast forward a few years later after college, after losing our house in the recession and after having kids. We didn’t need as much help so we settled for doing our own taxes online using the H&R Block tax software. It was easy to use and only took up a couple of hours of my time. This year though, it’s different. We bought a house last year and had to document all of my blogging income, so we now we need a super duper maximum tax refund because we want to go to New York for the kids’ summer vacation. So I’m heading back to H&R Block. We’re going to make an appointment, take our papers in and work with a tax professional to prepare our tax return.

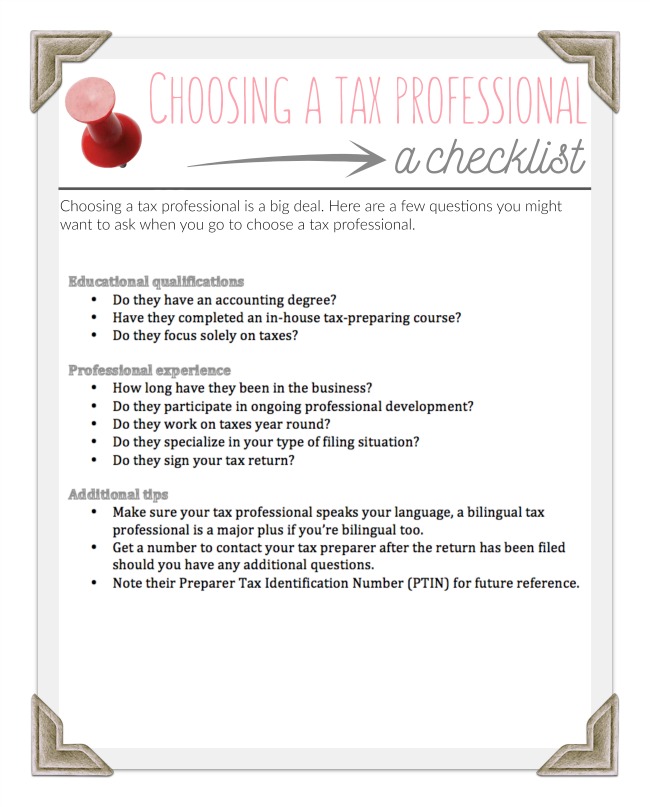

We used a checklist that I made up when we were looking for a tax professional, and H&R Block fit everything to a tee. We invite you to use our checklist when choosing a tax professional to ensure that you get a good tax return experience, and hopefully enough money back to use on a summer vacation too.

Personally, I’m going to have a quick run-down on this list and I’m going to add a few more questions. I’m super concerned about making sure that my business profile is kept intact – that I’m reporting everything as it should be, and I’m deducting what I can. I also want to make sure that all of our house paperwork is intact because it’s our first year adding it in our tax return and I want it to be done correctly. Besides, I heard that you get a major tax break by owning a home and I don’t want to miss out on any additional tax refund that may be coming to us.

Personally, I’m going to have a quick run-down on this list and I’m going to add a few more questions. I’m super concerned about making sure that my business profile is kept intact – that I’m reporting everything as it should be, and I’m deducting what I can. I also want to make sure that all of our house paperwork is intact because it’s our first year adding it in our tax return and I want it to be done correctly. Besides, I heard that you get a major tax break by owning a home and I don’t want to miss out on any additional tax refund that may be coming to us.

And on a side note, for the love of everything that is good, take a look at my last post that I wrote in partnership with H&R Block. It has a handful of easy tips to prepare for tax season that you’ll find useful as April 18th nears (and hey, they’ll still be useful next year too!). Hang in there – it’s almost over.

[disclaim]

This is a sponsored conversation written by me on behalf of H&R Block and Latina Bloggers Connect. The opinions and text are all mine.

[/disclaim]

Originally published on February 22, 2016. Last Updated on February 24, 2016 by Pattie Cordova